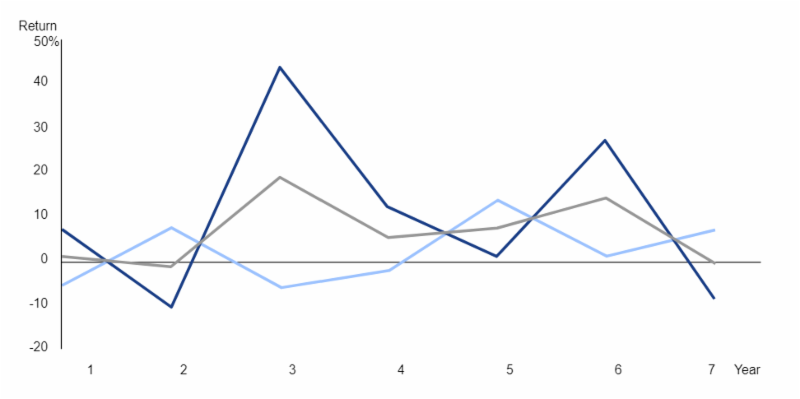

A few years ago, Lee Freeman-Shor was an institutional asset manager with access to significant resources. He funded accounts with 45 of the world’s top investors and requested that they each hold no more than ten stocks. The purpose was to focus on "best ideas."

Over the next seven years, Freeman-Shor then reviewed every single trade (30,874 of them!) and published the results in a must-read classic for investors, The Art of Execution.

Freeman-Shor’s study found that only 49% of their investments were profitable, and that some “legendary” investors made money on fewer than 30% of their trades.

How can you make money by being right on 1 out of every 3 trades? Is it still possible to win, even if you wrong most of the time?

He realized that successful investors knew instinctively what to do when a trade was working against them. They didn’t just sit with losing positions…. they did something.Some bought, others sold, but they all took some kind of action.

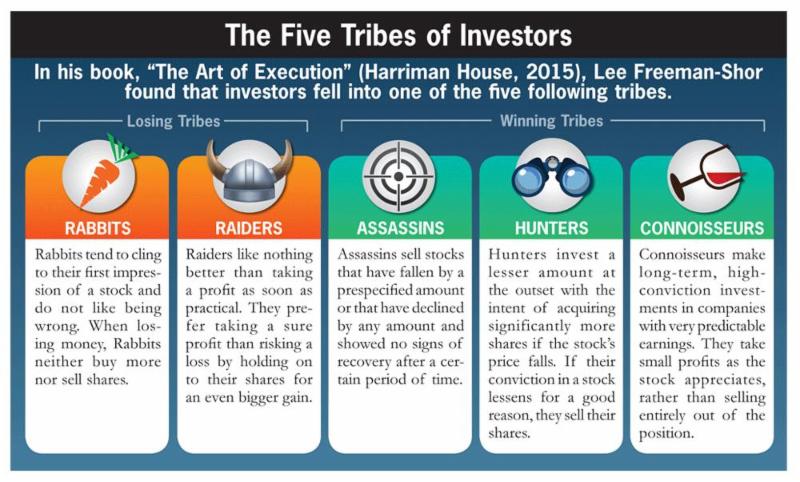

Digging into the decision-making process of the world’s top investors Freeman-Shor identified five key “tribes” of strategy: “Assassins”, “Hunters", “Rabbits”, “Connoisseurs”, and “Raiders”.

Assassins are the calculated “killers” of portfolio management. They excel at limiting their losses and moving on to the next opportunity.

Assassins have no attachments. When they buy a stock, they determine how much they are willing to lose before cutting their losses. Once that line is crossed, an investment is sold. No exceptions.

- Typically, assassins might lose between 20-30% on a stock position before they stop the bleeding.

- They will also sell stocks if that haven’t generated a gain within 6-12 months after the original purchase.

A typical assassin’s portfolio will often have “stop loss” orders. These are a special type of "sell" order that is automatically executed if a stock drops below a certain level.

By getting out of losing investments quickly, assassins have more opportunities to find the next big winner.

Hunters watch their stocks carefully and buy during moments of weakness.

- If a stock drops by 20%-30% from the original purchase price, they double-down and buy more shares.

- If a stock drops by 40% from the original purchase price, all shares are sold.

Hunters typically will take smaller initial positions. This keeps cash available for them to “buy the dips”. On the second round of investments, hunters typically purchase the same dollar amount as the first round. This means buying more shares at a lower price. It’s a basic form of dollar-cost-averaging that tilts stock volatility in their favor.

While hunters and assassins have seemingly opposite strategies, they both have a discipline and stick to it. As you might guess, it is impossible to be both a hunter and an assassin. You are either one or the other.

Rabbits are the least successful tribe of investors.

- Rabbits dig holes so deep that they never see the light of day again. This means that their losses become large enough that they can never recover.

- Rabbits buy stocks, but never update their research or change their mind. They just keep telling the same stories over and over again.

- Rather than admit to being wrong, rabbits simply run away from the problems in their portfolio.

So, with rabbits there is no exit strategy. The problem with holding onto extraordinary losses is that they require an even more extraordinary gain to recover. After taking a 90% loss, a stock requires a 900% gain in order to break-even. The odds of that ever happening are minimal to non-existent.

Being a great investor goes beyond knowing what to do when things go wrong. It also requires knowing what to do when investments become profitable and things go right. There are two strategic archetypes for success – the “Raiders” and the “Connoisseurs.”

Raiders are too hasty in selling out of winning positions.

- Raiders are “in and out” of their investments, hoping to make a quick profit.

- Emotionally, selling for a small short-term profit usually feels great. Unfortunately, this is a strategy for losers.

Freeman-Shor found that many investors will start selling a position after making a 20% gain.

The study found that 60% of the investments that were sold for a profit of 20% or less continued to see higher prices after the sale. Raiders are often too hasty and often leave a lot of money on the table.

If you keep taking small profits, you will never have a big winner.

Connoisseurs know how to enjoy their gains.

- Connoisseurs prefer to invest in quality businesses that generate steady, predictable earnings.

- They savor their best investments. Connoisseurs will toss out the swill early on, but let the finer vintages age in their collection.

- Connoisseurs tend to be hoarders. On special occasions, they might pull out a bottle from their collection for their enjoyment, but they will almost never consume (sell) everything at once.

- When connoisseurs find something good, they will hold a lot of it. They know what they like. Instead of keeping a bottle or two, they'll have an entire crate. As a result, some connoisseurs have a significant portion of their portfolios in just one or two stocks.

Conclusions

Most successful investors start out as Assassins or Hunters before they are able to find their first big success. At that point, they may “graduate” and mature into Connoisseurs. It’s usually OK to take some small losses, so long as you can also generate a few big wins. The key here is to keep your failures survivable and to make your wins especially rewarding.

Jim Lee, CFA, CMT, CFP®

Founder, StratFI

Disclosure: Information contained herein is for educational purposes only and is not to be considered a recommendation to buy or sell any security or investment advice.