(302) 884-6742 | Schwab Login | Morningstar Portal

You'll find the second and third floors of our house completely loaded with books. My wife and I both just love to read. For Steph, it is mostly literary and historical fiction. I'm an avid reader of business books, trends, philosophy, and sci-fi. Maybe 40-50 titles per year for each of us.

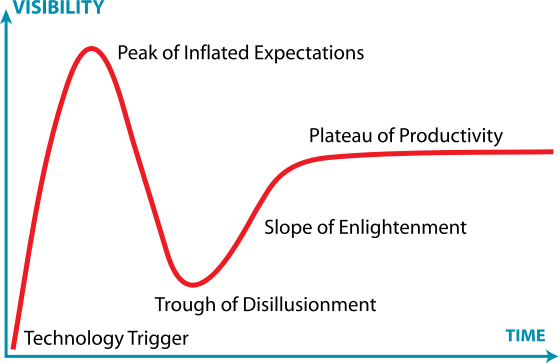

As a professional investor, it feels like 2017 was a year of tremendously hyped stories. Artificial intelligence, autonomous vehicles, blockchain, immuno-oncology, and marijuana legalization all had their moments in the spotlight.

Billions of dollars were made, billions of dollars will be lost.

But how do you analyze a speculation with no history and no profits? There are some explosive opportunities in the markets, and many of these defy any reasonable financial analysis. (I run into this problem with biotech stocks all the time.)

This month, I'll outline a process for evaluating some of these "story stocks."

What is the story? Why is it compelling? Is it easy to explain? If you can, write down a synopsis of why this is the next big thing.

How big is the story? What's the upside here? Will this be just a niche market, or is it a technology/service/product with broad implications? Also, what is a size of the company relative to the opportunity?

Is it real? Would this story be shelved in the "fiction" or "non-fiction" category? Do the main characters (an organization, its founders, and key personnel) appear to have both depth and realism?

Who knows the story? Some stories have been around forever. Others are comparatively new. The fresher the story, the higher its conversational value. The best stories are often unknown to most people.

Are there alternative narratives? What is the competition? Are there more compelling stories out there? What could go wrong?

When does the climax happen? Are there expectations leading to a key event, such as an FDA approval, a big earnings report, or legislation? Key events can add to the hype and excitement, only to be followed by realism. As the saying goes, "buy the rumor, sell the news." By the time that news becomes completely public, the best opportunity may have already passed.

How does this story end? It is usually a good idea to determine this before making a trade. What is your exit strategy? Do you have an upside target price where you'll take profits? Also, do you have a stop-loss to limit your downside and signal that you need to move on?

Position sizing is important here. That means not making any big bets when there is a lot of risk involved. (I prefer to keep my mistakes small.)

When done well, understanding the story behind a speculation can take just as much time and effort as research done using a classic textbook approach.

Jim Lee, CFA, CMT, CFP®

Founder, StratFI

Disclosure: Information contained herein is for educational purposes only and is not to be considered a recommendation to buy or sell any security or investment advice. Securities listed herein are for illustrative purposes only and are not to be considered a recommendation.

There is something irresistible about doing things that people say can't be done. Like trying to beat index funds, or timing the market.

With interest rates coming off all-time lows, bonds are looking less and less attractive for diversification. Real estate is also at risk, particularly if Trump's tax reform plans go through. Meanwhile, stocks have been the "best game in town" for a long, long time. This bull market has been going on since March of 2009 and is the second-longest on record.

Clients are happy with their recent gains, but are beginning to ask me "how long can this go on?"

Strategic Foresight Investments LLC (StratFI) is a Registered Investment Advisor (RIA) registered in the State of Delaware.

To Check Firm or Individual Backgrounds please go to Finra’s Brokercheck.

Copyright ©

StratFI