Seeing in Patterns

As a finance guy, I'm fairly obsessed with the question of "what comes next?" Statistical pioneer Jim Hurst once said that 75% of forecasting is about finding the right trends, and 25% is about understanding cycles.

Next month, I'll be hosting an event at the Grand Opera House and sharing some of the biggest trends for the next decade (details below). This is really fun stuff. But there is simply so much information to provide that I won't be able to talk much about cycles, which I hope to do here.

One of the most statistically significant cycles is happening right now. And it occurs without fail. It is called "autumn". This time of year, people get serious about their finances.

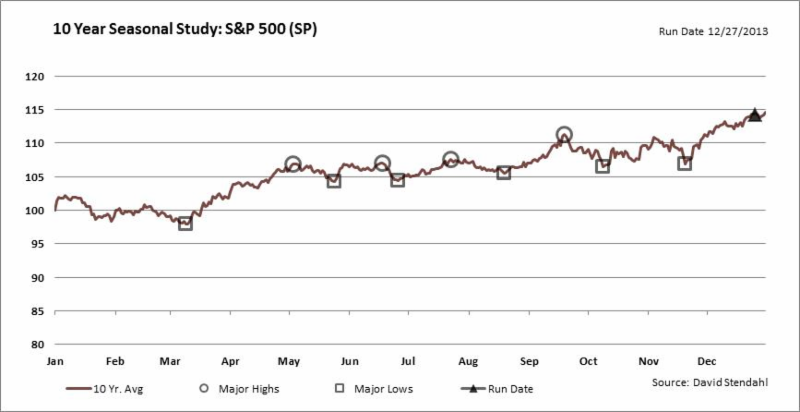

It is also the time of renewed interest in the markets. Here is the seasonal pattern for stocks in the U.S.:

Do you notice the "flatness" that seems to happen from May 1st to October 31st? See how the chart tends to advance between October and the end of April?

According to The Trader's Almanac, this pattern has been around since the 1950's, with the winter half of the cycle generating average returns of +7.6% and the summer half gaining only +0.3%.* The pattern exists for any number of reasons, including investor complacency, slower capital inflows, and systemically excessive optimism on the part of Wall Street analysts.

So, one way to reduce risk is to wait out the summer months with a little extra cash. May is a great time to take profits, while October is often a good time to reinvest them. While this pattern doesn't hold every year, it suggests "back to school" is another way of saying "let's get back to investing."

Jim Lee, CFA, CMT, CFP®

*Worth mentioning that the same seasonal pattern holds for countries in the southern hemisphere. This might suggest buying Buenos Aires when you are selling Stockholm. As Jim Cramer says, "there is always a bull market somewhere."

Disclosure: Information contained herein is for educational purposes only and is not to be considered a recommendation to buy or sell any security or investment advice. Securities listed herein are for illustrative purposes only and are not to be considered a recommendation.