Riding the Hype Cycle

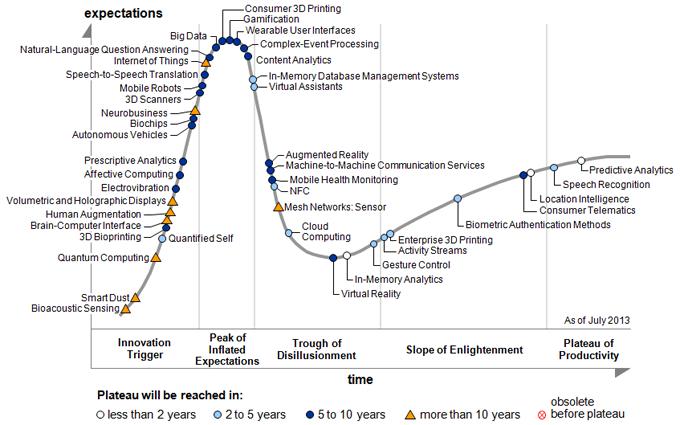

Wondering what’s hot and what’s not? Take a look at the Gartner Hype Cycle, which follows the progress of new technologies. According to Gartner, emerging technologies typically move through phases of overenthusiasm and disillusionment before becoming commonplace reality.

Gartner just released its 2013 Hype Cycle last week. The focus this year is on human-to-machine interactions.

The Hype Cycle was never intended as a guide to buy, sell, or hold specific companies or industries. From the perspective of process, however, it may be useful as a model for evaluating appropriate tools and time frames for investment.

Companies at the early stage of the Hype Cycle tend to have strongly negative cash flows, but increasingly abundant and positive media coverage. Traditional accounting analysis just does not work here – revenues and earnings are often non-existent.

Stock prices usually accurately reflect public perception, however, and standard technical analysis tools such as moving averages, accumulation/distribution ratios, and relative strength can be very useful in spotting when these companies are turning the corner into a period of disillusionment.

Stocks rising up the first leg of the Hype Cycle are ideal for short-term speculative trading. These companies typically see the biggest price-movements on a day-to-day basis.

By the time a company hits the peak of inflated expectations, you typically find their shares trading at unrealistic multiples to both earnings (if they exist) and revenues. These companies and technologies have moved into the public conversation and receive glowing coverage from mainstream media.

Bubbles sometimes peak with high-profile IPOs in “the next big thing.”

Companies that are overpriced and experiencing negative momentum make excellent candidates for short-selling. Short-selling is a bit like making money in reverse – you borrow shares to sell them high, and then repurchase them for replacement at a lower price later (if your hunch is successful).

As news coverage comes back to reality, companies sometimes get oversold. This may actually be sweet spot for making long-term investments. It is the point when technologies are reaching acceptance, valuations are reasonable, and public perceptions are stabilizing. Everything starts to come together at the same time. This is a foundation for what I refer to as convergence investing. Companies which survive the trough of disillusionment sometimes have the most attractive risk/return profiles.

The Hype Cycle is a useful reality check – just one tool to help determine if you are on the right side of a trade. Your personal temperament and style may decide how you use it – speculating, shorting, or investing.