Investing in Graphene - The Nanomaterial of the Future

Name one material that has the following qualities: superstrength, superconductivity, self-cooling, anti-bacterial, anti-corrosive, photovoltaic.

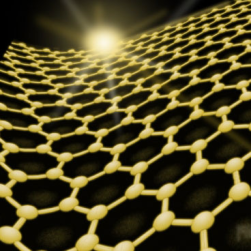

Carbon is one of the most abundant elements on the planet, yet in the form of graphene it has unique qualities. Graphene is a sheet of carbon that is just one-molecule thick. Rows upon rows of interconnected six-sided carbon molecules are linked together in a way that is unusually strong, yet flexible.

Its discoverers were awarded a Nobel Prize in physics during 2010.

Despite its humble origins (it was first created by peeling a thin layer of pencil graphite using sticky tape), graphene is already showing a head-spinning array of applications.

Here are some headlines from the past few months:

Thin as paper and ten times stronger than steel

Graphene paper is six times lighter, two times harder, and ten times stronger than steel. Researchers believe that graphene could be used to make faster, lighter, vehicles that are fuel-efficient and generate considerably less pollution.

Graphene is 100x more electrically conductive than copper.

It conducts electricity with almost no resistance – promising a future of faster, more energy efficient computers and electronics.

Graphene is the thinnest anti-corrosion coating (and it’s transparent, too!)

Graphene is five times thinner than conventional anti-corrosion coatings. A one-molecule thick layer of graphene on a sheet of copper will slow the rate of corrosion by 85%.

Graphene creates electricity when struck by light

When a specially prepared sheet is struck by light of almost any wavelength, the material’s superconductive qualities convey the resulting temperature differential in the form of electricity.

Graphene transistors self-cool

Graphene transistors can convert a portion of heat-output back to electricity, making them cooler and more energy efficient.

Graphene’s anti-bacterial qualities make it ideal for wound-dressings.

Tests at Lanzhou University have demonstrated the graphene derivatives are bio-compatible with human cells, and can combine with chitosan (a blood clotting agent) to create a wound dressing that significant reduces healing times. One hypothesis suggests that the relatively thin cell walls for most bacteria make their DNA vulnerable to breakdown due to the exchange of electrons with graphene.

Granted, this is a pretty over-the-top list of applications, but if even just one or two of these breakthroughs are applied commercially, the opportunities will be enormous.

Investment Opportunities:

Research

Nearly 200 companies are involved in graphene research, including IBM (ticker: IBM),Intel (INTC), Sandisk (SNDK), and Samsung. While all of these companies have extensive patent portfolios, none of them are a “pure play” on graphene, as it is just a small part of their current R&D efforts. Samsung is currently the leader in research (with 60 patents) while Sandisk has roughly 30.

Mining

Since 2005, raw graphite prices have almost tripled. Annual graphite production is at about one million tons per year, seventy percent of which is coming from China. Interestingly enough, today’s lithium-ion batteries use more graphite than lithium. Roughly 130 pounds of graphite are needed for a single electric car battery.

Graphite is also an important component of the non-reactive pebble beds needed for the next generation of nuclear reactors. Rechargeable batteries and pebble beds reactors alone could double graphite demand by 2020.

It is difficult to invest in graphite directly, given that there is no futures market in the U.S. The simplest approach is to purchase shares of graphite mining companies.

The quality of graphite from China has been on the decline over the past few years and most of the recent mine development is happening in Canada. Focus Graphite (FCSMF) is one such company. It hopes to become the world’s lowest cost producer of large-flake graphite. Northern Graphite (NGPHF) is another Canadian mining company in pre-production phase. Like Focus, there are no revenues or profits yet, however, it seems further along the path towards financing and development. They expect to start production as early as 2013.

Processing graphite from raw mineral sources can produce large flakes that suitable for pebble-bed reactors and batteries. However, higher quality graphene can also be synthesized in the lab using industrial gases. This process, known as chemical vapor deposition, produces precise sheets of graphene suitable for use in semiconductors and microelectronics.

Industrial Production

Aixtron SE (AIXG) is a German company that has taken huge beating in the past year, but still looks expensive at 80x earnings per share, with very limited profitability on current revenues. The best way to think of this company is as a semi-conductor stock that is well-positioned to transition to graphene electronics.

At $0.55 per share, China Carbon Graphite (CHGI) is at the low end of its trading range and is attractively priced. It is also extremely speculative — this one may be too volatile for most investors.

Graftech (GTI) is an old-line graphite manufacturer that has been in the carbon and graphite industry for over a century. First quarter sales and profits for 2011 were comparatively weak. Graftech is the twelfth-largest patent holder for graphene-related research.

CVD Equipment Corporation (CVV) just makes sense to me. CVD is a one-source destination for graphene production and quality control equipment. It also manufactures and sells graphene through a wholly owned subsidiary. Graphene is a large part of its business and on the basis of its financials alone appears to be worthy of consideration.

Currently at the low end of its price range ($13.25) CVD trades at just 20x trailing earnings. Both revenues and earnings per share nearly doubled last year. So far as investments in graphene are concerned, I have more confidence in CVV than any other.

Final Thoughts

Graphene has the ability to become a transformative technology for multiple industries, including chemical coatings, electronics, transportation, healthcare, and energy. Emerging technologies such as this can take a decade or more to move from the lab to widespread commercial adaption. Graphene technology today is where silicon technology was in the 1950’s. In the short-term, graphite seems to be benefiting from recent increases in demand, but the real game-changer is graphene.

As with most investments, it is important to understand your own tolerance for risk and perform your own due diligence. Most graphene-related investments are still high risk, and any portfolio allocations should be relatively small. For more updates, consider visiting www.investingingraphene.com.

(June 19, 2012. Disclosure: The author owns shares of CVD Equipment Corporation, Sandisk, Focus Graphite, Northern Graphite, and China Carbon Graphite as of the release date of this article.)