This year, I've been doing a lot of "thinking out loud" about the future of cities and real estate. The technology that seems to have the greatest buzz (and there are several) appears to be autonomous vehicles.

So, let's have some fun with this and spin the wheel of implications.

Urban Landscape: Today, cars are parked 95% of the time. Smart cars have places to go and things to do. They could be out moonlighting and generating additional income while they are waiting for your evening commute. Life gets complicated when cars have an agenda of their own.

Winners: urban redevelopers, walkable cities

Losers: parking attendants, meter maids.

Car Sharing: Why own a single vehicle, when you could have the right car for any occasion? A mini-van for soccer practice, an energy-efficient commuter car, or a pick-up truck for weekends at Home Depot? The average car costs a total $8,500 per year (or, $25 per day) for insurance, maintenance, payments, and fuel. Autonomous vehicles could shift the paradigm from ownership to access by repositioning transportation as a service.

Winners: teenagers, the poor

Losers: public transportation systems

Automotive Design: What if you could order a car as easily as a pizza? Would you always want pepperoni, or would get a little crazy and ask for chicken teriyaki barbeque? Cars have been boring for the past 30 years because they attempt to do everything and keep everyone happy. As cars are ordered on-demand and ownership declines, we may see whole new classifications of vehicles, including single-person commuting pods, sleeper cars (for long-distance travel), business class vehicles (with workspaces and mobile wi-fi), and party shuttles (which encourage drinking, not driving).

Winners: creatives, recreational vehicle manufacturers

Losers: automotive dealerships

Shortened Product Cycles: What if cars wore out as quickly as laptops or cell phones? If cars are shared and utilized 8 hours a day, we'll need a fraction of the current number of vehicles in use. It also might be quite possible that these cars will be putting on 30,000 - 50,000 miles per year. As a result, cars will need to be replaced (and upgraded) much more quickly. They also might consume more energy, not less, for the trips that they are running with no passengers.

Winners: progress, energy providers, recycling?

Losers: business-as-usual

Liability Coverage: What happens when an autonomous vehicle crashes? Today, 85% of all accidents result from human error and 36,000 deaths are caused per year. If there is no human involved, who do you blame? There is a good chance that manufacturers will be forced to provide their own warranty coverage, covering liability in the event of an accident due to vehicle malfunction. This will be paid for by car sharing fees.

Winners: public safety, auto companies

Losers: traditional property-casualty insurers, lawyers

Hyper-Commuters and Long-Distance Travel: Long-distance commuters everywhere will rejoice if they can get to work refreshed and nap on their way home. Cars might become so comfortable that we could almost live in them. What if that happens?

Winners: fitness clubs (gotta shower somewhere)

Losers: hotels, airports, aviation industry

From an investment perspective, we believe that manufacturers of recreational vehicles (including Winnebago, Thor Industries), automotive suppliers (Magna, Harmon), companies involved in the Internet of Things (NXP Semiconductors, Mobileye, Nvidia), and the supply chain of rechargeable batteries (Albemarle, FMC, LithiumX) could be well-positioned for the emerging future. Cars may soon become the 6th screen, and provide enormous amounts of consumer information to be processed and stored (Google, Facebook).

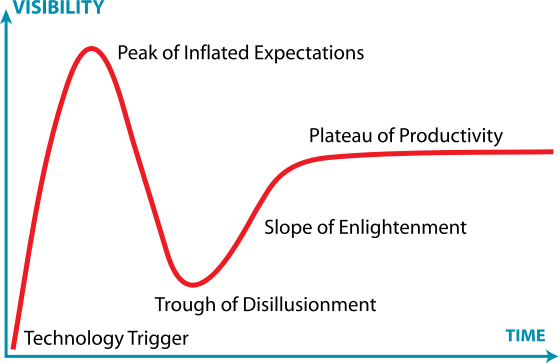

So, what kind of time frames are we looking at here? Social barriers to adoption aside (regulations, etc. - a very big "if"), most automotive companies are estimating that they will have technology ready for mass production by 2023-2025. It could easily take 13-15 years for old cars to wear out and new cars to be placed into circulation. That would put us out to 2036 for 50% deployment, or 25-30 years to 2048 and beyond for 90% deployment.